ELIGIBILITY CRITERIA

Secure your family’s dream

Minimum 5 Years

Maximum 60 Years

Minimum 18 Years

Maximum 74 Years

For age 50 years and above : 10 / 15/ 20 years

Minimum | Maximum | ||||||||||||

Monthly – Rs. 2,500 Yearly – Rs. 30,000 |

Yearly Monthly

|

Plan Related Documents

KEY BENEFITS

Why this plan suits your needs

KEY BENEFITS

Why this plan suits your needs

8 funds to invest

Receive guaranteed loyalty additions

Avail Tax Benefits

Provides flexibility to manage investments

Get financial protection for loved ones

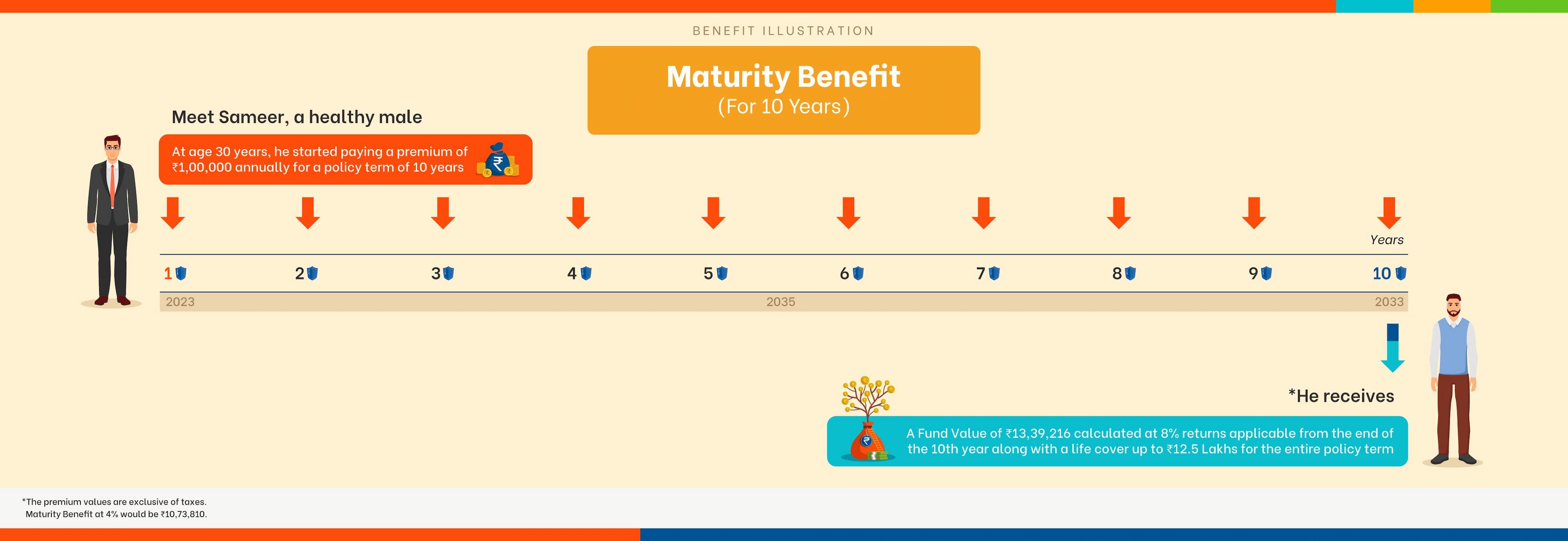

Benefit illustration

Let’s help understand with an example

EVERYTHING ABOUT WEALTH GAIN INSURANCE PLAN

All your questions answered

Ageas Federal Life Insurance Wealth Gain Insurance Plan is a special type of insurance that helps you build wealth over time. It offers you a smart way to save money and also provides financial protection for your family. With this plan, you can invest your money and watch it grow steadily with potential returns. So, you can secure your future and achieve your financial goals with ease.

Ageas Federal Life Insurance Wealth Gain Insurance Plan helps you secure your future financially. This plan offers a smart and flexible way to build wealth, with potential returns on your investements. Moreover, it provides vital financial protection for your loved ones, ensuring their well-being in times of need. You'll enjoy tax benefits as per prevailing tax laws, making it an attractive option for saving on taxes. Embrace this plan for peace of mind and the assurance of a financially secure tomorrow.

In case of death of the Life Assured during the policy term, death benefit would be paid to the nominee which is higher of death sum assured or fund value or 105% of the single premium received.

Maturity benefit is equal to the fund value including total guaranteed loyalty additons in your investment account on the date of maturity provided the policy is in force. Once the maturity benefit is paid out, the plan terminates.