ELIGIBILITY CRITERIA

Secure your family’s dream

Minimum 1 month

Maximum 70 years

Minimum 18 years

Maximum 76 years

Tenure Fixed options

6 years / 10 years/ 15 years/ 20 years/ 25 years

Single premium

Minimum ₹ 50,000

Maximum No Limit (Subject to Board Approved Underwriting Policy)

Age at maturity ≤ 48 years 1.25 times / 10 times Single premium

Age at maturity > 48 years 1.25 times Single Premium

Plan Related Documents

KEY BENEFITS

Why this plan suits your needs

KEY BENEFITS

Why this plan suits your needs

Pay premium only once

Flexibility to choose from 8 funds and switch among funds

Get loyalty additions to boost your fund value

Facility to increase or decrease life cover as per changing needs

Tax Benefits may be available on the premium paid and benefits received as per prevailing tax laws

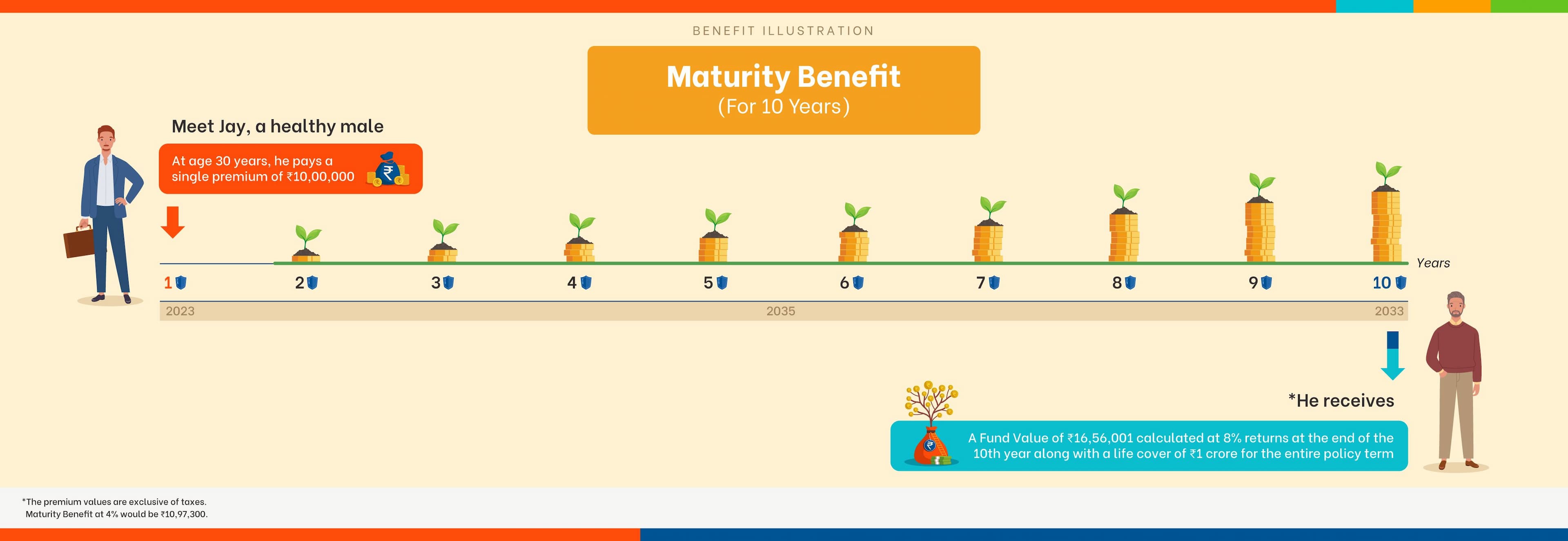

Benefit illustration

Let’s help understand with an example

EVERYTHING ABOUT WEALTHSURANCE GROWTH INSURANCE PLAN SP II

All your questions answered

Ageas Federal Life Insurance Wealthsurance Growth Insurance Plan SP II is a single pay plan, it needs you to pay just once. The plan offers multiple options and choices that enable you to personalize it as per individual needs and priorities. The life insurance aspect of the plan ensures financial security for loved ones, all through the journey. Plus, there are features and facilities to provide liquidity in case of any contingencies.

In case of death of the Life Assured during the policy term, death benefit would be paid to the nominee which is higher of death sum assured or fund value or 105% of the single premium received.

On survival of the Life Assured till the date of Maturity, Fund Value including Loyalty Additions shall be paid on the date of Maturity, provided the policy is in force.

Loyalty additions will be 3% of the average fund value in the last 36 months preceding the loyalty addition date. The investment account will be credited with loyalty additions at the end of 6th policy year, 10th policy year and every 5 years thereafter subject to the policy being in force.